Introduction of sales invoice

In the fast-paced world of business, efficiency and professionalism are essential in ensuring your operations run smoothly. The Sales Invoice is one of the most important documents that make it easier to conduct transactions without much hassle. Regardless you are a small business proprietor, freelancer, or large corporation, a structured sales invoice guarantees clarity, legal adherence, and quick payments.

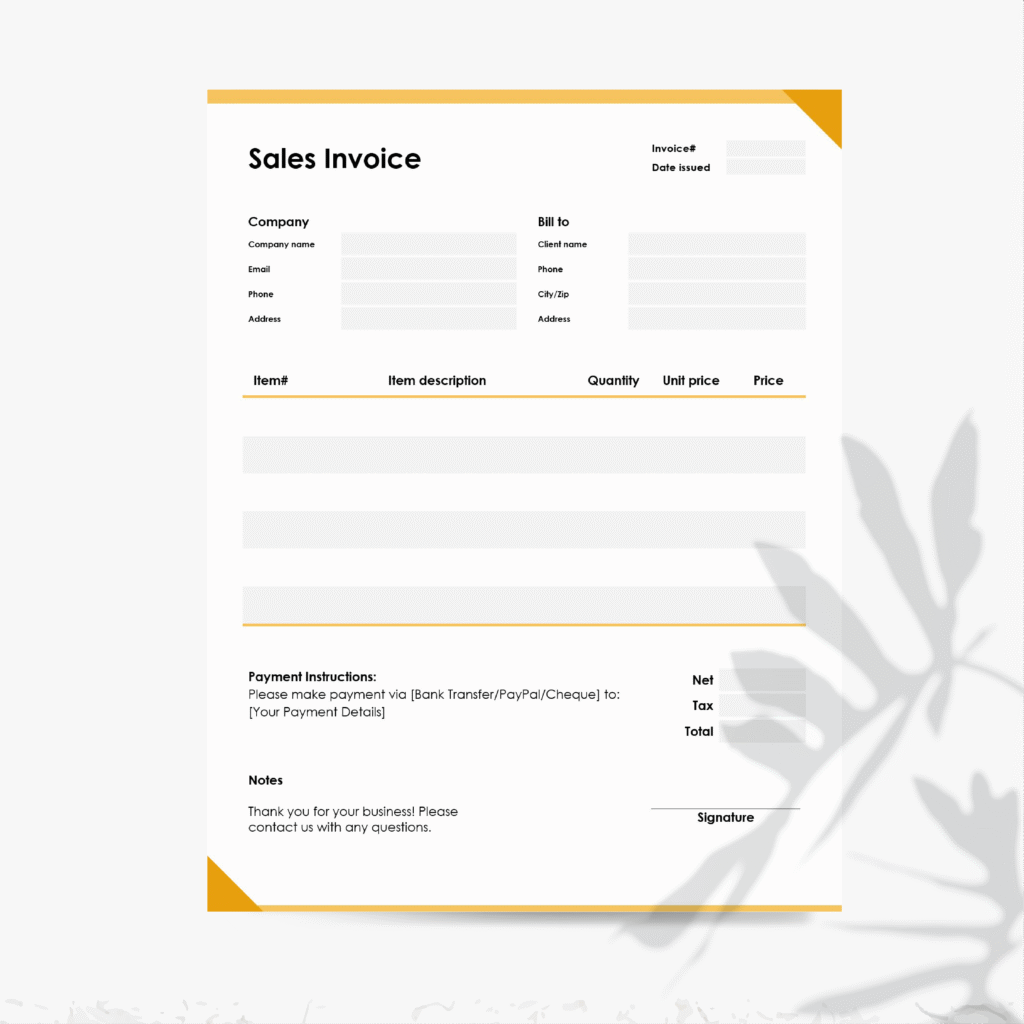

If you need something to streamline your invoicing work, we now have a free, editable purchase contract templatethat you can use to manage your business affairs. Let’s start with types of sales invoices and their use, why have them, info needed for it, and difference between sales receipt and invoice.

Types of Sales Invoices

There are multiple types of sales invoices, each catering to unique business requirements. The types below are the most prevalent:

Standard Sales Invoice

Standard sales invoice: This is the most commonly used type of invoice, listing the products or services provided, quantities, prices, and total amount payable. This is applicable for almost all kinds of businesses like retail, wholesale, and service providers.

Commercial Invoice

Commercial invoices are typically used in international trade when goods are passed across borders, including more information such as customs declarations, harmonized system (HS) codes, and shipping terms. It is crucial for cross-border transactions.

Proforma Invoice

A proforma invoice is basically a sort of preliminary bill of sale that is used before the shipping of the goods. It is commonly used to provide customers with a preliminary idea of costs before finalizing an order.

Recurring Invoice

A recurring invoice is created on a monthly, quarterly, or yearly basis, at the same rate for subscription-based services (like SaaS businesses and membership services).

Credit Invoice

A credit invoice (or credit memo) is created when a refund or adjustment needs to be made — because of returned goods or overpayments, for example.

Debit Invoice

On the flip side, a debit invoice is used to collect more money for undercharging, additional services, and price adjustment.

Why Use a Sales Invoice?

BILLING: You can find all of these on a sales invoice Here are all the reasons to get one:

Legal Proof of Transaction:Legally, a sales invoice acknowledges that goods or services were purchased in exchange for payment. It assists in resolving conflicts and works as proof in the event of audits or legal problems.

Ensures Timely Payments:An invoice clearly indicates payment terms (due date, ways to pay, late fees) and helps clients with effective payment that ensures cash flow.

Easy Accounting & Tax Compliance:They provide a way to track your income and expenses, which can help when you file your taxes and for bookkeeping. They form the basis of VAT, GST and sales tax reporting.

Enhances Professionalism:A branded, well made invoice looks professional and helps build trust with your clients, enhancing your brand reputation.

Essential Details on a Sales Invoice

Below is a summary of some elements that need to be included on your invoice to make it complete, and legally acceptable.

- Business & Client Information

- Business name, address, contact information, and logo

- The name, address and contact information of the client

- Invoice Number & Date

- The unique invoice number helps to track payment and the Issue date establishes the timeline for terms of payment.

- Description of Goods/Services

- List of products or services with for each a description and price

- Item quantity, price per unit and line total

- Payment Terms

- Due date

- Payment methods accepted (bank transfer, credit card, Paypal etc)

- Interest on late payments (if you’re charging it)

- Tax Details

- Taxes applicable (VAT, GST, sales tax)

- Employee Identification number (if applicable)

- Total Amount Due

- Final amount to be paid, with taxes, discounts and extra charges

- Additional Notes

- Return policy

- Thank-you message

- Special instructions

Sales Receipt vs Sales Invoice: Important Differences

Sales receipts are often confused by many people with invoices, but they serve different purposes:

Feature

Sales Invoice

Sales Receipt

Purpose

Request payment for goods/services

Confirms payment was made

When Issued

Before payment

After payment

Payment Status

Payment is pending

Payment is completed

Level of Detail

Such as payment terms, due date

Shows payment method, date

Legal Use

Used as accounting, tax records

Serves as proof of purchase

Have a sales agreement or agreement of purchase contract template (used for long-term affairs) or you have a proof of purchase receipt for a simpler sales receipt.

MS Word Sales Invoice Template Free Download How to Use

Our MS Word tablature template for Downloadable Sales Invoice is simple to use.

Download the Template – Download it from the page on our site.

Branding- Add logos, details about the business, color of your scene.

Fill in Transaction Details – Enter client information, products/services, and pricing.

Choose Payment Terms – Add payment due date and methods.

Save & Send – Export to PDF and print/email to your client.

Conclusion

A correctly organized sales invoice is a key factor of efficiency and compliance for organizations, as well as financial management. Our free MS Word Sales Invoice Template not only saves your time, but keep you professional and ensure smooth transactions.

Get your template now and start streamlining your invoicing today!