For optimal operational management, all sectors need to automate the capturing of sales through invoice automation. In the year 2023, marketing performance tracking and services invoice automation refers to the accuracy achieved through invoices. Most people still select invoice templates that will best serve their needs and have all necessary fields in them. Unlike other companies, our platform offers clients a variety such as: Simple invoice templates, commercial invoices, and many other types which are customisable. In this article I will explain the 20 invoice templates which we believe are the most useful and describe the occasions when each of these templates should be utilised.

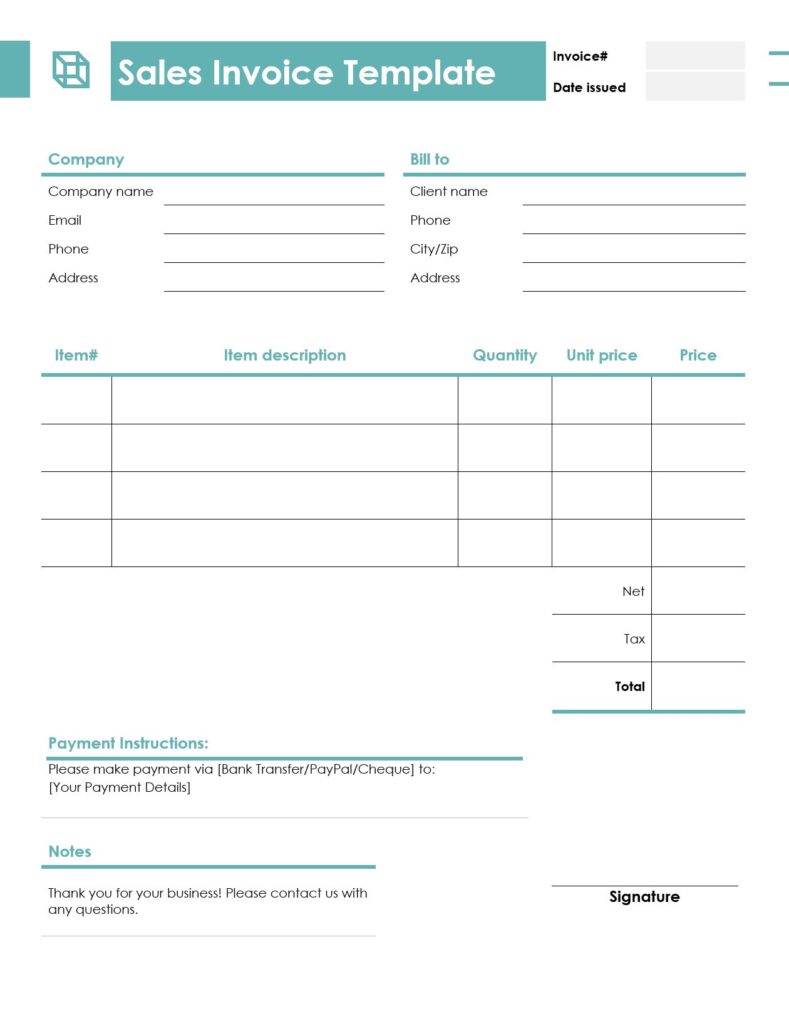

1. Sales Invoice: The Core Of Every Business Transaction Sales Invoice Particulars

Due to the information conveyed, a sales invoice serves a critical purpose. A company’s sales invoice functions as its internal record, while, externally, it acts as the buyer’s purchase order. A business’s legal and financial matters depend on its internal sales records and thus, the value of a business invoice is immense. Building trust and ease of transactions are reliant on sales invoice trust. Mastering sales invoice particulars with professional document creation will enable all transactions to be seamless.

Seller and Buyer Information

The complete name, address, contact information of the seller and buyer should be incorporated for every invoice. These details allow for both parties to be recognized which is very crucial, especially during disputes to settle.

Invoice Number and Date

Along with an invoice number, each document comes with a set date with a docusigned issue date. Organising company documents, payments alongside surmountable due dates become easy. Convenience is increased drastically, ambiguity remains nonexistent, and overall, productivity improves.

Quantitative List of Goods/Services Required

A describe inventory with several services or products entails item description, quantity, price per each unit, and total. Increasing clarity and trust from a business’s clientele is achieved with regard to inter-business trust.

Payment Conditions and Taxes

Outline a given range of payment terms that need to be adhered to, and any taxes that need to be paid. Gaps and ambiguity are always the basis for misunderstanding. Unproductive delays can be avoided providing that clearly set questions.

When it is applicable:

All businesses expect payments and issue sales invoices upon receipt of goods. Invoices are standard requirements that verify transactions for retailers and traders and collect pending amounts.Our company’s invoicing template enhances efficiency with a clear outline and structure that is customisable. Every business can modify the template according to its specific needs depicting that uniformity enhances efficacy. Template customisation optimises time for all businesses by cutting down on errors, whether it is a small startup or a large corporation.

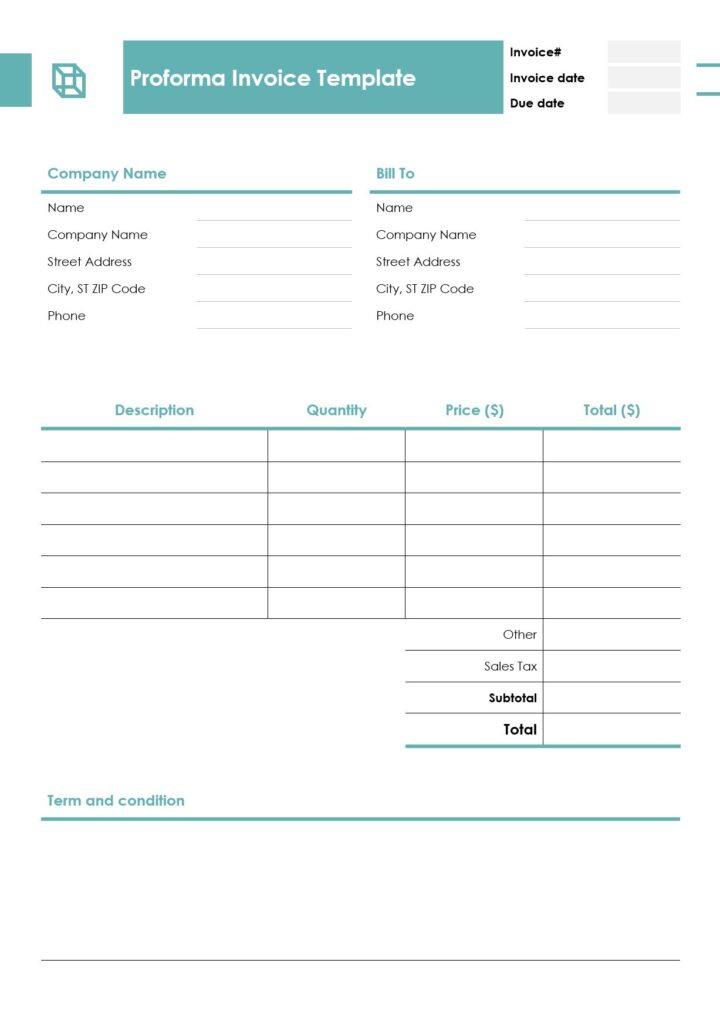

2. Use Simple Proforma Invoice template for initial sales*

A proforma invoice can be defined as an initial bill of sale provided to purchasers prior to a dispatch or delivery. It summarizes the goods to be sold, their prices, and terms of sale, thus preventing conflicts. Knowing proforma invoice specifications is important for effective movement of goods across borders.Proforma invoice is free invoice template that can be download.

Seller and Buyer Information

A proforma invoice must have the complete legal title, name, addresses, and contacts of both the buyer and seller. This detail is important in mitigating issues regarding correspondence and delivery.

Quantitative Notes of the Product

Add a detailed comprehensive account of all the items alongside their quantity, unit price and description. This also allows the proforma invoice useful for import and customs documents.

Payment Terms

Specify the payment details, for example, 50% payment in advance and the remaining due upon delivery. There should be no ambiguity concerning financial arrangements in a proforma invoice.

Transport Details

The mode of transport, the likely time of delivery, and shipment charges are some of the details that also need to be highlighted in the pro forma invoice.

When Its Use Is Appropriate:

Most of the time, pro forma invoices fulfil the seller’s need when calculating the cost to be incurred by the buyer. This document circumvents numerous issues regarding international shipments and custom orders because it enables the buyer to understand the payment that needs to be made prior to the final payment invoice.You can now create documents using our advanced document generators to obtain professionally made proforma invoices, helping foster open communication between clients and businesses.

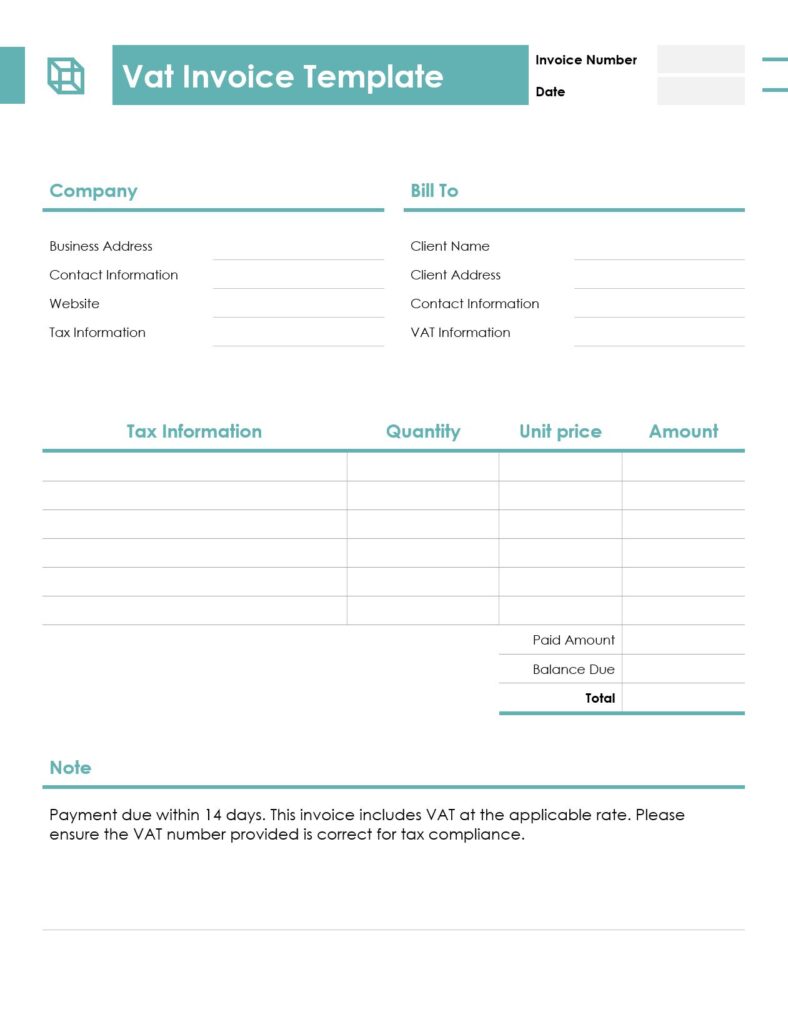

3. For Compliance with Revenue Collection Bureau Requirements -TAX Invoice

Understanding tax invoice specs is key to being compliant and having clean financial records. Whether you’re a freelancer or a big company, a well formatted tax invoice helps to simplify transactions and avoid legal hassles.

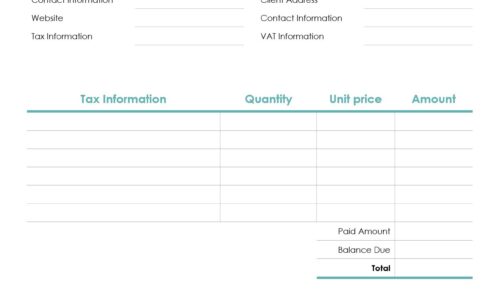

Tax Breakdown List the tax rates and amounts separately. Make sure total tax and grand total is shown on the tax invoice.

Basics Tax invoice must have seller’s name, address and tax registration number. It should also have invoice number and issue date.

Buyer Details Buyer’s name and address. If buyer is registered for tax, their registration number should be mentioned on the tax invoice.

Product or Service Description Each item or service should be clearly described along with quantity, rate and total value. This will help in calculating the tax on the tax invoice.

When Its Use Is Appropriate:

In the first instance, this invoice type is required after the occurrence of every invoice that bears VAT or tax on it.More often than not, it contains the value added tax registration number of the business alongside the tax that is levied on the total value of their goods and services incurred.In peripheral regions, using our direct tax template allows editing of the invoices to add sections of VAT for legal compliance with taxation. Simply modify the template value to conform to each country’s requirements.

4. Consolidating Invoicing:A single invoice covering several sales or transactions.

An invoice is a vital part of every single business, but with rapid growth, businesses find it challenging to manage multiple invoices at once. One of the ways multi-level business enterprises are automating processes is by consolidating invoicing, which certainly simplifies the billing processes. This specific invoice management strategy saves businesses a good chunk of time while improving financial organization.

What is Consolidated Invoicing?

Invoicing broadly covers a branch termed Consolidated Invoicing, and this is where billing companies combine different invoices in one provided document. This specific approach targets helping businesses have far better control of their finances by eliminating the hurdles that come with tracking multiple individual payments that complicated the process.

Advantages of Consolidated Invoicing

Reduction of administration work marks consolidation of invoicing the most welcoming change. Eliminating and combining account payable invoices enables businesses to dedicate more of their time and efforts to their core operations. Greater cash flows due to reduced processing costs mark the change that takes place in forwarding invoices.

How to Implement Consolidating Invoicing

To better implement consolidated invoicing, businesses first need to identify the most appropriate invoicing system which allows invoice amalgamation. Consolidated invoices need to have all the vital information explicitly detailed to eliminate chances of confusion that make the inaccurate and sum their amounts together.

When to Use It:

This invoice is issued to clients that have a combination of transactions over a week or a month in such a manner that only one payment will settle all the transactions, reducing the administrative burden meant to house many different types of documents that manage the transactions.In the past few years, our clients are reported to have used our invoice templates that are designed with a multi-level itemised section enabling several purchases to be paid via a single payment document.

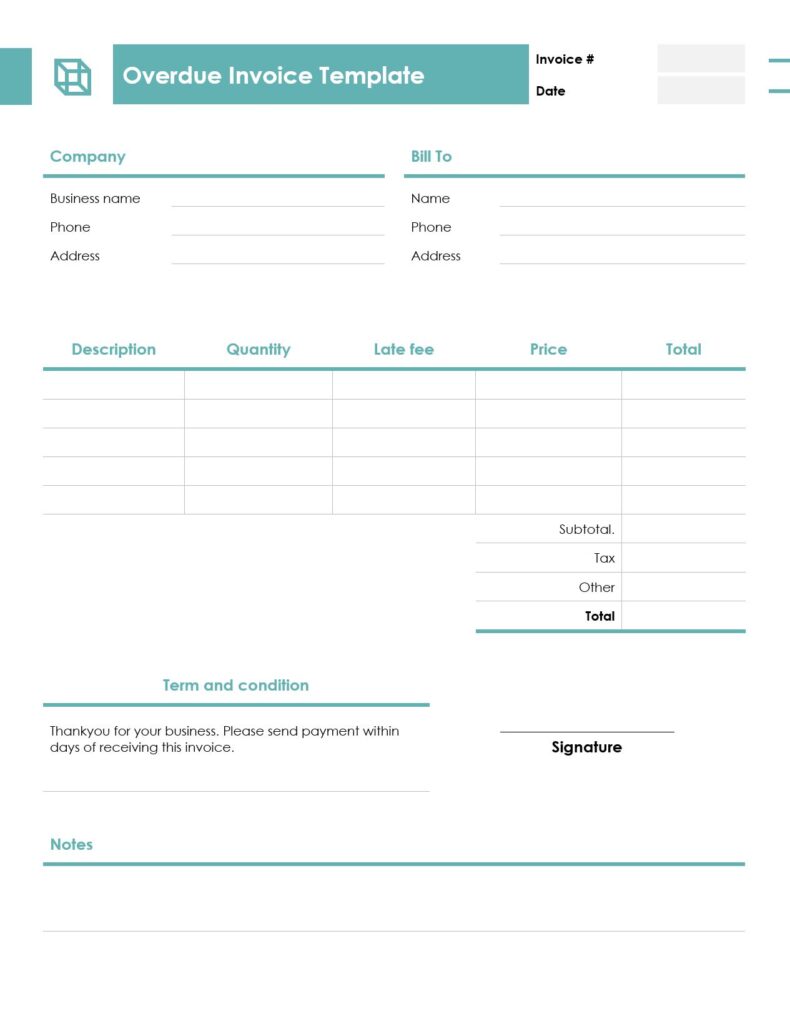

5. Overdue Invoice: Invoice that reminds you to pay more of an incentive.

Dealing with late payments can be frustrating, but having a past due invoice template that’s well-designed can help you in this alarming situation. Whether you are a freelancer or small business owner, maintaining strong communication is important when reminding customers of past due payments.

What is a Past Due Invoice?

A past due invoice is a formal notice, sent after a payment deadline has passed. It’s broken down with original invoice details, late fees and a new payment due date.

Why Use a Template?

A template for past due invoices saves time and provides consistency. It also gives it a more professional look which can prompt them to pay you faster.

Key Elements to Include

Every overdue invoice must include the name of the client, the original due date, the total amount owed, and the payment options. A message when you accept but firm while polite enough could keep the relation in good terms.

Customization Tips

Customize your past due invoice with your business’s branding and tone, and give some direction on how your customer should pay their past due invoice.

Tell us—do you use a past due invoice template? Drop a comment below!

When to Use It:

Anyone who falls within the category of clients who are not up to date with their payments is eligible to make this payment. These clients are clearly those who defaulted in remitting their payment by the timeline stipulated in the invoice.

The purpose of this invoice is to aid the collection of overdue payments while still maintaining a courteous tone.

At the click of a button, free invoice templates available online can be modified to include overdue invoices, payment deadline reminders, and other necessary information, all within a remotely operated payment reminder system.

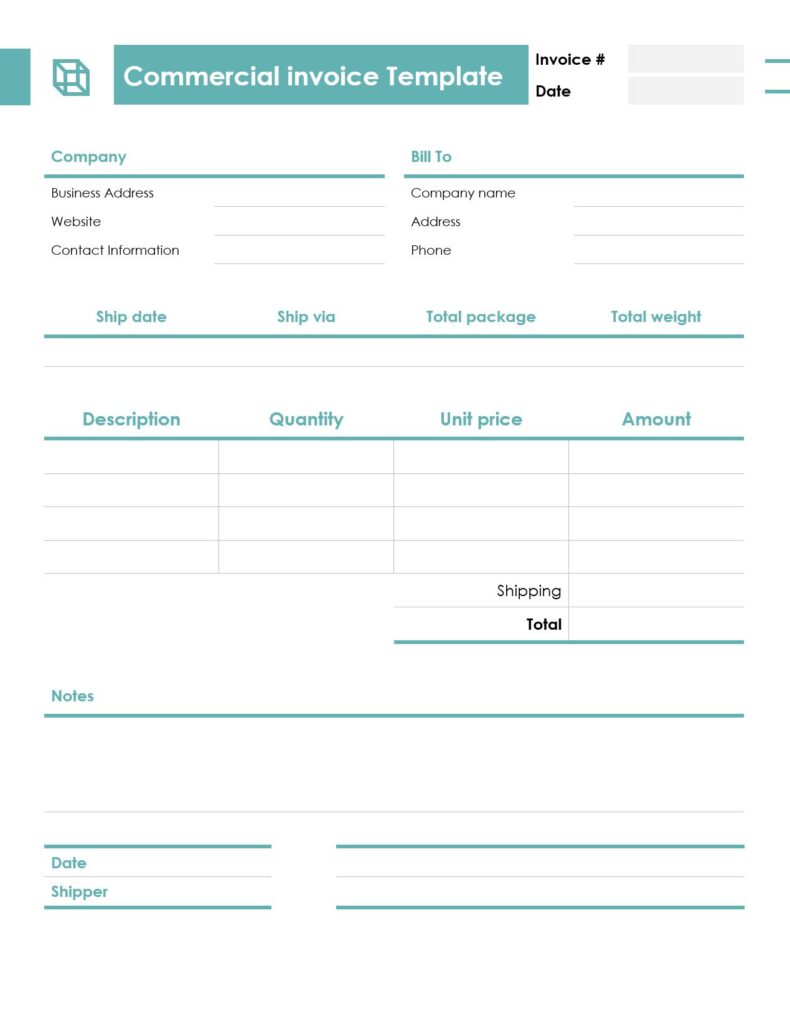

6. Commercial Invoices Serve an Important Role in International Trade

The commercial invoice template you use in international trade can make or break your transaction. This vital paperwork is crucial for seamless customs clearance, correct tax assessment, and every effective bookkeeping.

Header Information

Your business name, address, and contact information are required on a professional commercial invoice template. There should also be the buyers information as well as an invoice number so it can be tracked.

Product Details

Each product’s name, description, quantity, unit price, and total cost need to be listed in the template. Having these fields helps ensure your commercial invoice template does not get rejected for any reason by customs.

Shipping Information

There may be clear shipping method, carrier, date and incoterms. Total Weight and Dimensions — An integral part of a commercial invoice template.

Declaration and Signature

Must be signed by the person authorized to sign. The last part makes sure to fulfill the legal requirements for your commercial invoice template.

To achieve hassle-free trade, you should use a proper commercial invoice template. Have questions or want to do a free download? Let us know in the comments below!

Use it when:

In international trade, a commercial invoice is mandatory when goods are traded. This documentation substantiates the claim for transaction reimbursement. This proof is required by the merchant surrendering the goods—the local customs or other government authorities will only permit payment of due taxes if they possess sufficient verifiable payment documentation through relevant documents submitted.

For information regarding international trade, our user sections provide our editable invoice template that allows you to meet customs requirements without any complicated concerns.

Project based invoices of which there are 6 types.

Project based invoices are issued for particular subtasks or milestones within a project that spans across a timeframe. These may be billed either at the completion of the individual task or on an hourly basis.

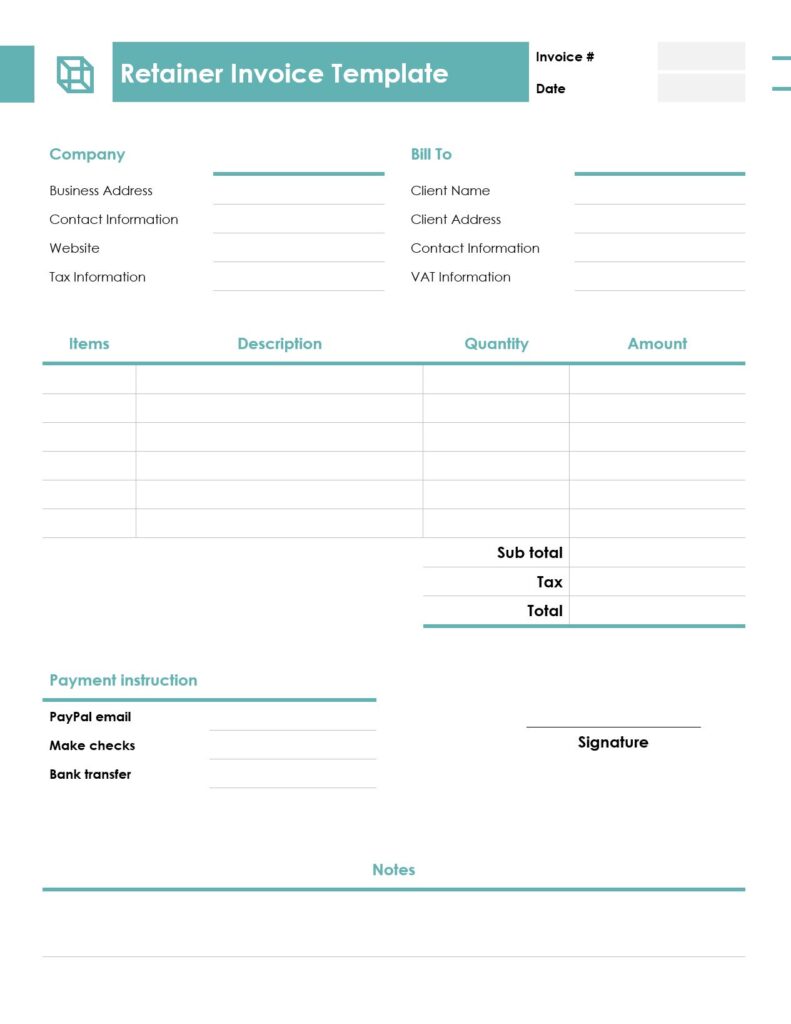

7. Retainer Invoice: Allocating Funds in Advance for Ongoing Works

Managing client payments efficiently starts with a solid retainer invoice template. Whether you’re a freelancer, consultant, or agency, having a professional and well-organized invoice boosts credibility and ensures timely payments.

1. What Is a Retainer Invoice Template?

A retainer invoice template is a pre-formatted billing document used to request advance payment for services. It outlines the scope, duration, and fee structure before work begins.

2. Benefits of Using a Template

Using a retainer invoice template saves time, ensures consistency, and reduces errors. It also makes your business look more professional and trustworthy.

3. Key Elements to Include

Your retainer invoice template should include client information, invoice number, payment terms, service details, and your business contact details.

4. Customization Options

You can personalize your retainer invoice template with your brand colors, logo, and specific terms tailored to each client’s agreement.

In conclusion, a strong retainer invoice template streamlines your billing process. Let us know—do you use one? Leave a comment below!

When should it be applied:

They are made when someone pays in full upfront to be serviced over a period of time. Besides, they are issued to assist in the estimation of revenue while ensuring that the corresponding customer’s obligation is not breached. All retainer invoices can be created using our free online retainer invoice generator and custom retainer payment plans.

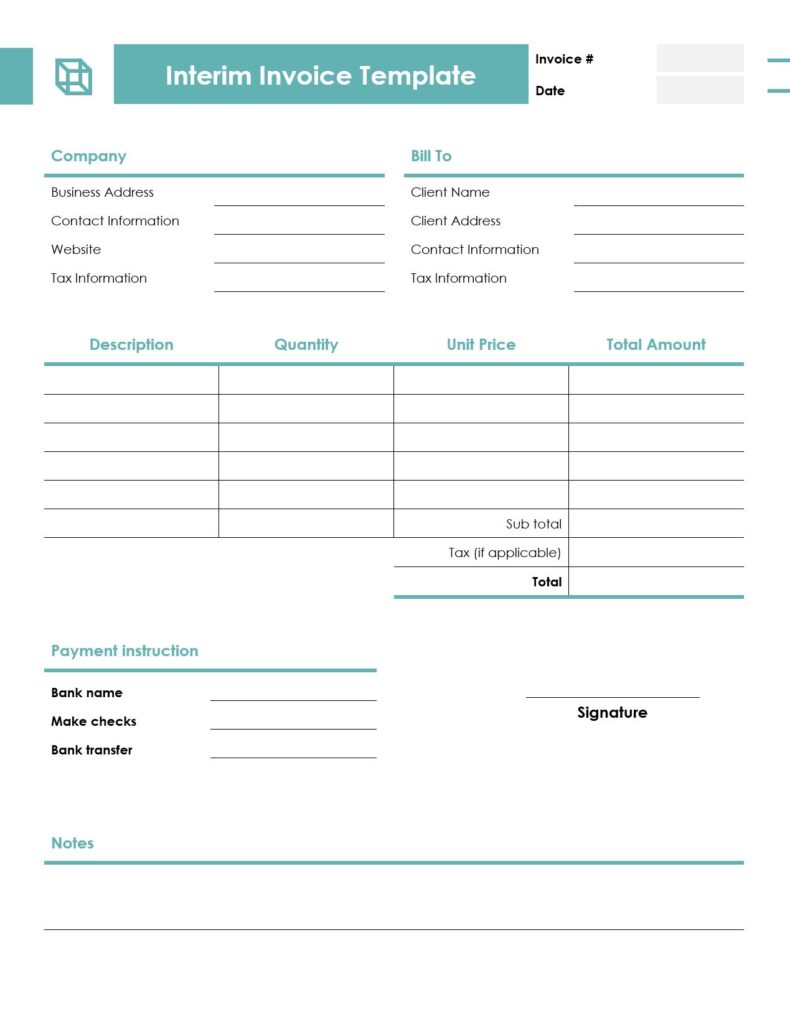

8. Interim Invoice–Best for Progress Payment Streams During a Project

When working on long-term projects, managing finances efficiently becomes essential. An interim invoice template helps businesses bill clients in stages, improving cash flow and reducing financial strain. Whether you use an invoice and payment system or a simple invoice template, interim invoicing brings clarity to both parties.

When to Send Interim InvoicesSend them after reaching agreed checkpoints. Ensure your invoice and payment records match up to avoid errors.

What is an Interim Invoice?An interim invoice is a billing document issued before a project’s completion. It lets clients pay in phases, especially for lengthy jobs. Using an invoice online template makes this process faster and more accurate.

Benefits of Interim InvoicingBy using an invoice and payment strategy, companies avoid delayed payments and maintain steady income. A simple invoice template ensures the format remains consistent and professional.

Customizing Your TemplateTailor the invoice online template with project milestones, percentages, or hourly rates. Clear details prevent confusion later.

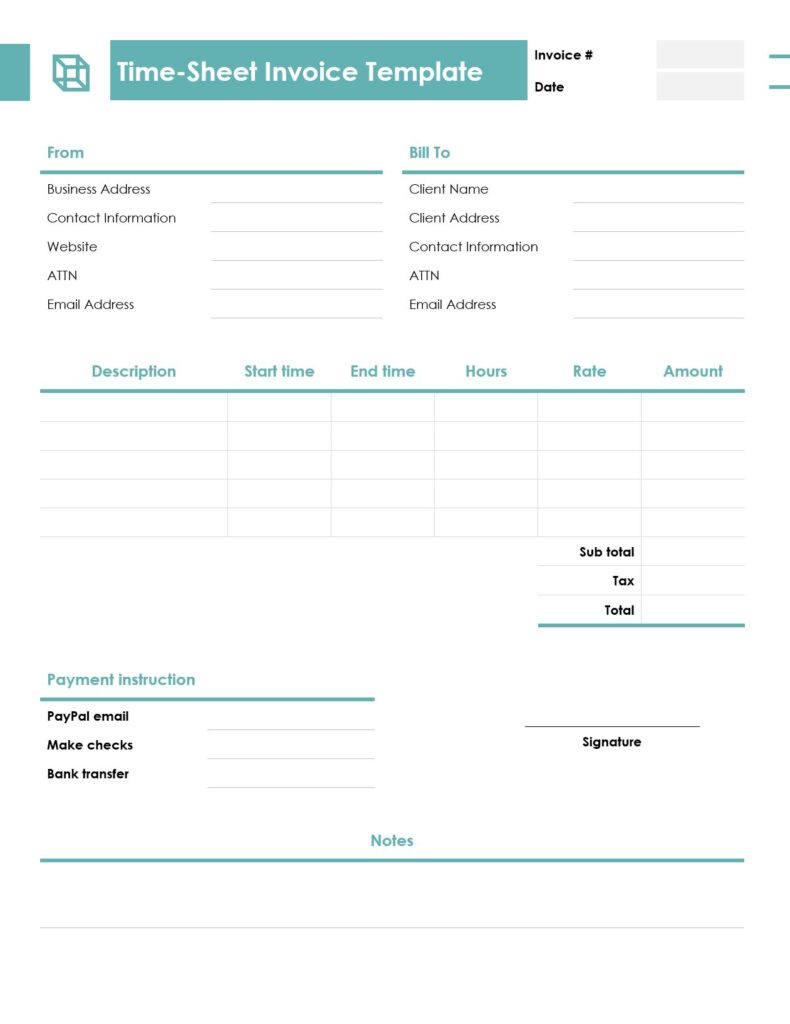

9. Time-Sheet Invoice: For Billing Based on Work Time

Time-Sheet Invoice Guidelines

Timesheet invoices can be a key piece in the puzzle whether you use payroll software or bill your clients. Accurate records make sure payments are made on time and operations run smoothly whether you are a freelancer, a contractor, or an employer. The process becomes easier with tools such as time sheets printable, timesheet invoice template, and customized invoices.

What is the use of a Timesheet Invoice?

What is a timesheet invoice? It documents the hours worked and associates them with a project or client. Paper trail where legal entries must reflect actual time spent when combine with time sheet printable.

Essential Elements

A complete timesheet invoice template must have employee name, dates, total hours, hourly rate, total amount due, etc. This information is easily compiled by using time sheets printable.

Formatting Tips

Use a clean and professional looking layout. It should be easy to read and update, be it a digital or a paper-made timesheet invoice.

Why Templates Help

Time sheets printable along with a timesheet invoice template results in consistency and a time-saving process.

Overall, recordings of invoice timesheet tools help to perform billing processes smoothly.

When to Use It:

Service providers who charge clients on a daily or hourly basis for services rendered are most suited to time-sheet invoices for contract work. With our template, users can complete timesheets including hourly rates and total hours worked associated with the invoice project along with other relevant details.

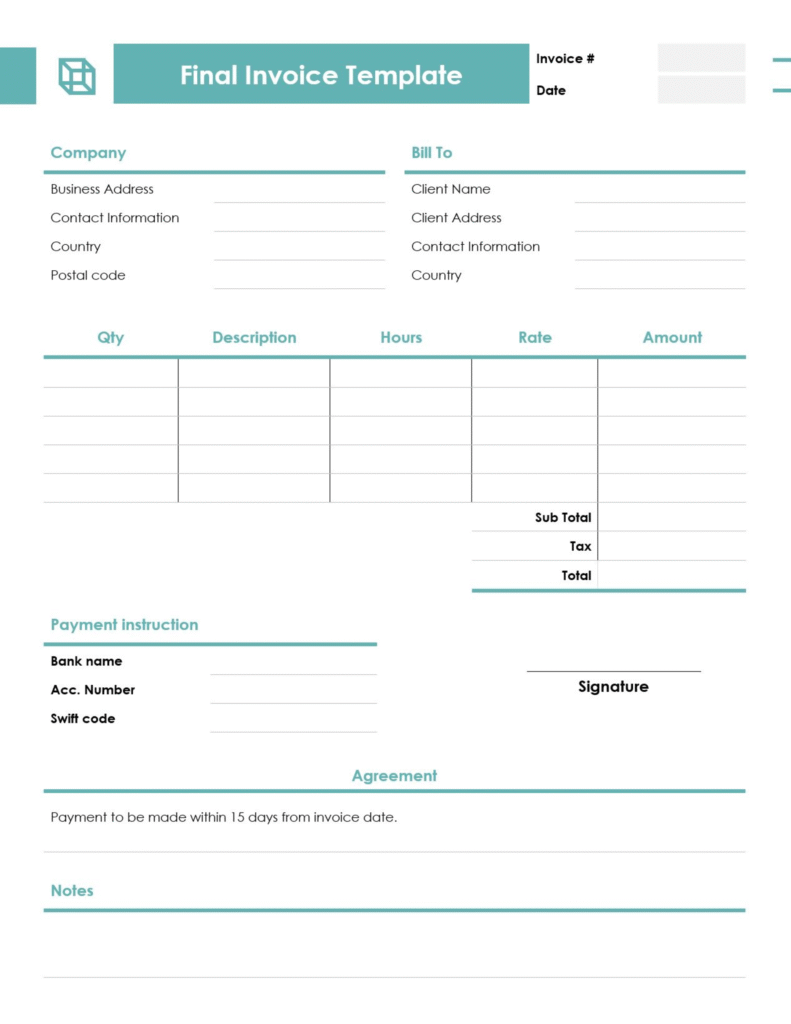

10. Final Invoice: Closing Out a Project

When it comes to billing your clients professionally, having a final invoice template is essential. It ensures you include all crucial details while saving time and reducing errors. Whether you’re a freelancer, small business owner, or contractor, the right final invoice template can streamline your payment process.

1. Clear Header Information

Your final invoice template should begin with your business name, contact details, and logo. This gives your invoice a branded, professional touch that builds trust.

2. Client Details

Include the client’s full name, address, and contact information. A detailed final invoice template ensures both parties are clearly identified for legal and accounting purposes.

3. Itemized Charges

List each product or service with descriptions, quantities, rates, and totals. A transparent final invoice template builds confidence and avoids confusion.

FAQ

What is the simplest invoice template:

This would be a document containing commercial header, description of goods or services rendered, pricing section, and total amount due.

Can I ask for customisation on the invoice template I want?

Certainly. All templates including invoices we provide are customisable to fit the specifications of your business.

Are templates provided at no charge?

Supporting businesses, regardless of their scale, is the purpose these templates, whether premium or free, are accessible to all companies.

How does a proforma invoice differ from a sales invoice?

A proforma invoice is an advance document outlining expected costs which summarises the goods or services before the sale.

What is the most effective approach for me to guarantee all my invoices align with tax laws and regulations?

Ensuring taxation and legislative obligations is incredibly simple with our VAT Compliant invoice templates specifically designed for that purpose.